Features and Benefits

Getting started is easy:

Establish a direct link between AvaTax and Volusion via a prebuilt connection that allows for seamless interaction. You won't need IT support to get started, in most instances.

Reliable tax calculations:

Volusion sends transaction data to AvaTax, and AvaTax sends back the tax total. Customers, salespeople, and others can see the tax owed in real time—in your shopping cart, for example.

Leave the updates to us:

AvaTax is updated at regular intervals to reflect changing rates and rules in the 12,000+ U.S. sales and use tax jurisdictions. That means you can stop looking up sales tax rates altogether.

Get a leg up on filing:

AvaTax takes you from sales tax calculation to filing in one fell swoop. Just pull your transaction data from AvaTax to prepare your returns each filing period, or let us handle your returns and filing as part of our Avalara Returns service.

Detailed reporting:

24/7 access to your AvaTax transaction history comes in handy for many reasons, especially during an audit. The dashboard is simple to navigate.

Feel good about your tax software:

With an up-to-60-day free trial and an accuracy guarantee (subject to our terms and conditions), AvaTax is tax software you'll appreciate having in your corner.

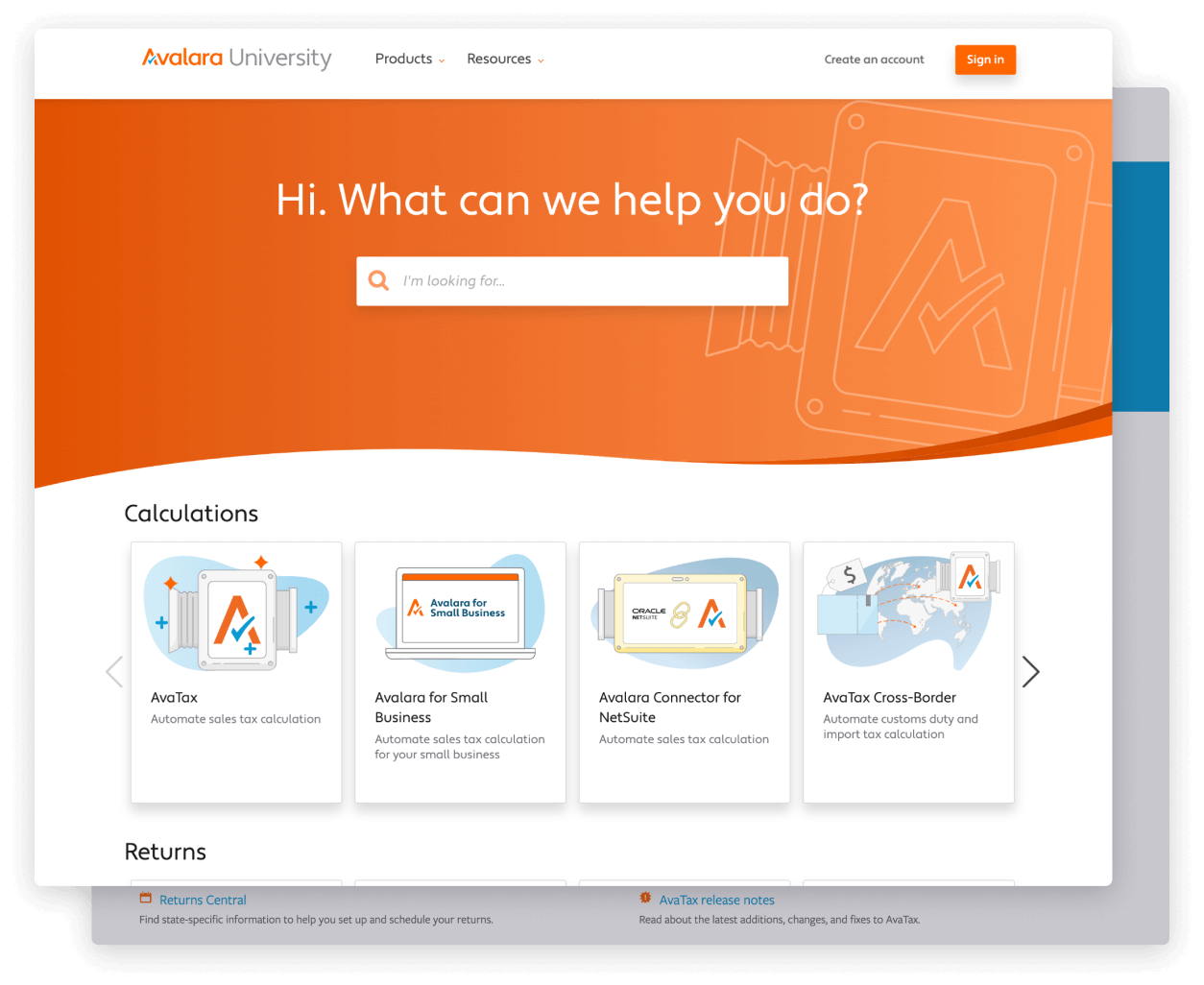

Learn how to use AvaTax

With a Help Center that includes free classes, on-demand videos, and more, you can learn how to use each part of AvaTax effectively. Avalara also offers technical support packages to help you implement and use the solution.

Configure AvaTax for your business

Our setup wizard walks you through each step of configuring AvaTax, from your company profile to your tax settings. Typical setup includes:

- Assigning and applying tax schedules to your customers

- Selecting calculation settings for various tax types

- Setting up taxability information for products

- Managing nexus settings

- Setting up tax exemption rules and tax-exempt customers

- Configuring more advanced rules

Identify where to collect sales tax (where you have nexus)

A key part of the setup process is designating the states in which you need to collect tax. Not sure? Get a nexus analysis study.

As tax responsibilities (including nexus) expand for your business, it's easy to have AvaTax collect in more places—it only takes a few clicks to update your nexus settings.